indiana estate tax form

The exemption for the federal estate tax is 1170 million in 2021 and increases to 1206. Income Tax Return for Estates and Trusts before you begin filling out Indianas Form IT-41.

Learn about getting more clients.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

. Business or occupation 3. Date of death 4. Instructions for Completing Form WH-4 This form should be completed by all resident and nonresident employees having income subject to Indiana state andor county income tax.

Form to be filed by executors of an estate and other persons required to file Form 706 or Form 706-NA to report the final estate tax value of property distributed or to be distributed from the estate if the estate tax return is filed after July 2015. Ad Download Or Email Form ST-105 More Fillable Forms Try for Free Now. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals.

Print or type your full name Social Security number or ITIN and home address. One Schedule A is provided to each. Form 8971 along with a copy of every Schedule A is used to report values to the IRS.

INDIANA PROPERTY TAX BENEFITS State Form 51781 R14 1-20 Prescribed by the Department of Local Government Finance THIS FORM MUST BE PRINTED ON GOLD OR YELLOW PAPER. Please read carefully the general instructions before preparing this return. Property taxes owed by the decedent.

Estate income tax through the fiduciary income tax return if more than 600 was made by the estate. Therefore you must complete federal Form 1041 US. Income Tax Return for Estates and Trusts before you begin filling out Indianas Form IT-41.

The state of Indiana requires you to pay taxes if youre a resident or nonresident who receives income from an Indiana source. Enter your Indiana county of residence and county of principal employment as of January. Find an Arbitration Attorney or Arbitrator.

Many of the necessary determinations are done at the federal level by the IRS. Therefore you must complete federal Form 1041 US. Prescribed by the Indiana Department of State Revenue InDIana InheRItance tax RetuRn foR a non-ReSIDent DeceDent note.

These taxes may include. Decedents residence domicile at time of death 5. If you need to contact the IRS you can access its website.

You can also order federal forms and publications by calling 1-800-TAX-FORM 800 829-3676. If you need to contact the IRS you can access its website at wwwirsgov to download forms and instructions. If you have a simple tax return you can file.

Ad Real Estate Family Law Estate Planning Business Forms and Power of Attrorney Forms. Social Security number 6. Ad Download or Email IRS 1041 More Fillable Forms Register and Subscribe Now.

The state income tax rate is 323 and the sales tax rate. All Indiana residents who earned income in the last year must file Form IT-40 with the Indiana Department of Revenue. The final income tax return of the decedent.

Find an Arbitrator for your case. The personal representative of an estate in Indiana must continue to pay the taxes owed by the decedent and his or her estate. Level and file Form IT-41 at the Indiana level.

Listed below are certain deductions and credits that are available to reduce a taxpayers property tax liability. Though Indiana does not have an estate tax you still may have to pay the federal estate tax if you have enough assets.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

:max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)

Form 1065 U S Return Of Partnership Income Definition

Irs Form 56 Instructions Overview Community Tax

Understanding The 1065 Form Scalefactor

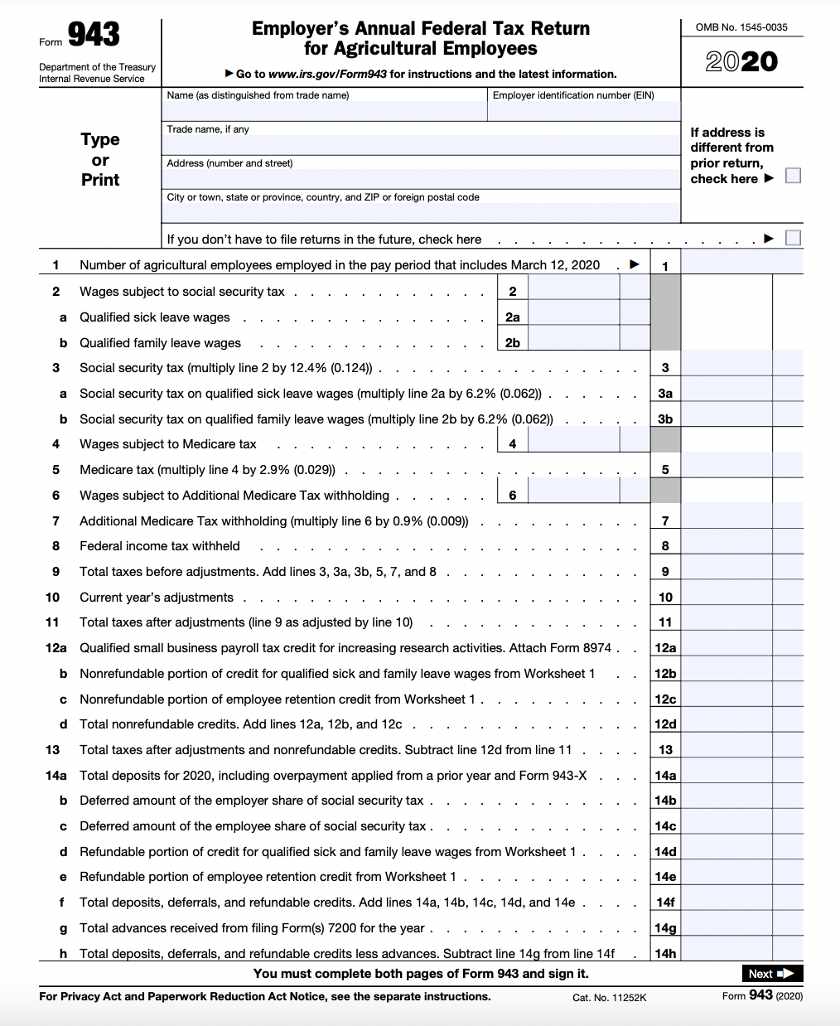

How To Fill Out Form 943 Step By Step Instructions Mailing Addresses

Simple Purchase Agreement Template Beautiful 37 Simple Purchase Agreement Templates Real Estate Business Stcharleschill Template

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

16 Printable Indiana State Tax Withholding Form Templates Fillable Samples In Pdf Word To Download Pdffiller

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

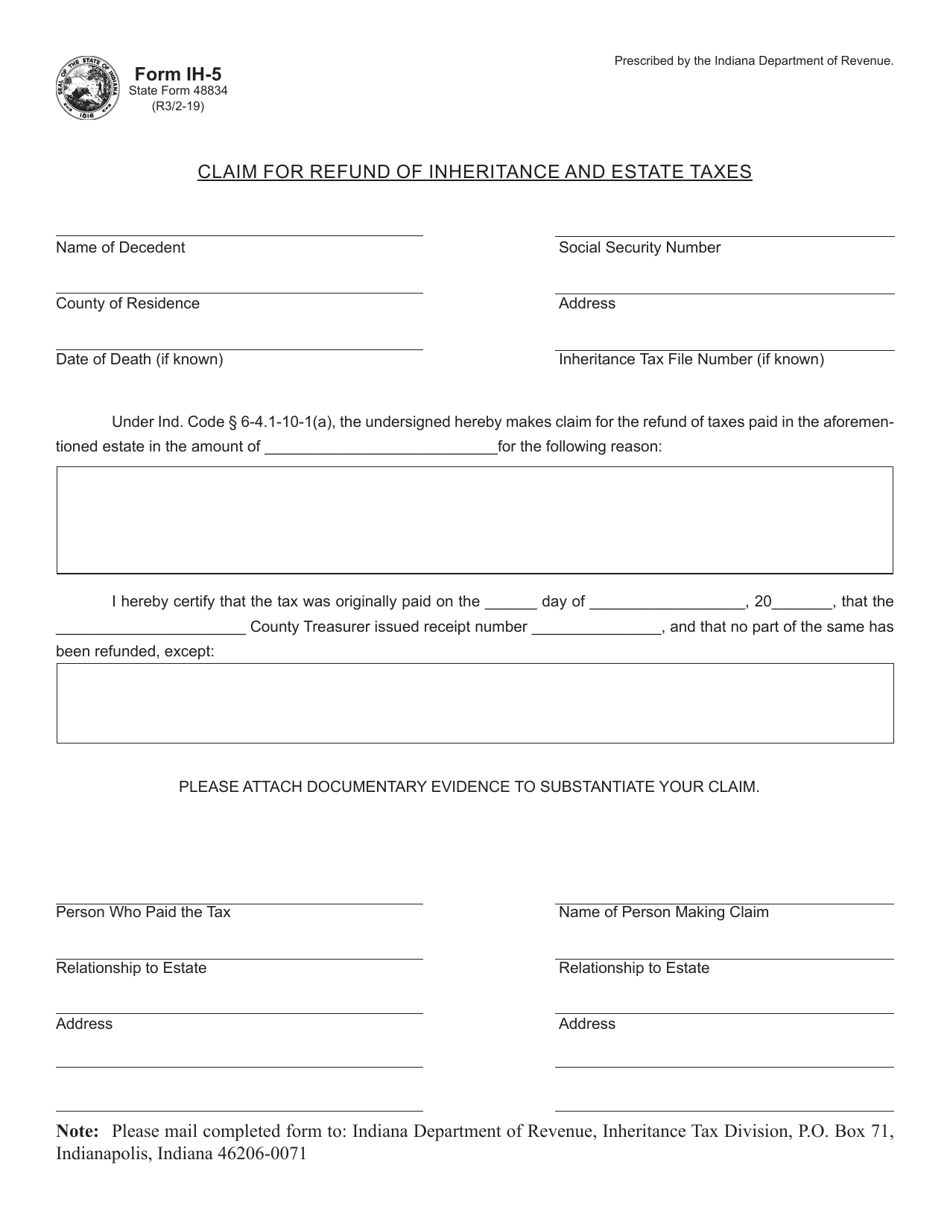

Form Ih 5 State Form 48834 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Tax Form Templates 5 Free Examples Fill Customize Download

House Of The Day The Biggest Mansion For Sale In America Can Be Yours For A Bargain 13 9 Million

What To Look For If You Re Moving To A Healthy Neighborhood Rentcafe Real Estate Education Real Estate Advice Real Estate Tips

How Long Does A Speeding Ticket Stay On Your Record D Turner Legal Llc Speeding Tickets Records Ticket

Tax Form Templates 5 Free Examples Fill Customize Download

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

:max_bytes(150000):strip_icc()/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)